Summary

Fox News host Julie Banderas warned that President-elect Donald Trump’s proposed tariffs—25% on products from Mexico and Canada and 10% on those from China—could significantly raise costs for Americans, as many businesses rely on foreign goods.

While some companies are shifting to U.S.-based suppliers or stockpiling goods ahead of the tariffs, Banderas noted that buying American often results in higher prices.

She highlighted that the financial burden would likely fall on consumers, questioning, “Who’s going to pay for that? We are.”

Economists have also warned of inflation risks.

Sure, yeah. It’s especially sucks for rich people and business owners, but no it’s not just “neoliberal propaganda.” It’s really simple economics and logic. If your money becomes more valuable over time, it is on your benefit to save it. If it becomes less valuable over time, the opposite is true and you should spend it. And yeah, capitalism sucks, but we’re all tied to the health of the economy, which doesn’t mean the stock market like the media often links it to, but if businesses can’t afford to hire as much staff, all of us lose.

This is true, but it’s a bad thing. The economy would be better off if people had savings. We could afford to strike without going homeless. We would consume less and pollute less. Wages would be growing in proportion to the overall economy, not falling relative to the cost of living.

Us being forced to spend money on businesses is good for the businesses, but it hasn’t been good for us. Businesses being able to hire more people because we’re forced to invest in them is trickle-down economics.

Wages would not necessarily grow in proportion to the economy. In fact, they probably wouldn’t. It’s a nice idea, but it’s assuming a lot. As more people are laid off, there’d be more people competing for the same jobs, allowing businesses to pay less. They’d also be in the same situation as everyone else, where spending is disincentivized. I don’t know about you, but I’ve never know a business to pay more than they have to.

As long as inflation is low, it doesn’t force you to spend money. In fact, saving is still encouraged because you can normally get higher returns than inflation. It just encourages you to not sit on money that isn’t doing anything. Every dollar spent multiplies. When money changes hands a fraction of it is saved, but the rest is spent. The more that’s spent and less saved the more effective dollars there are, as the federal reserve requires a fraction of every dollar saved in a bank to be stored in with the Fed where it can’t be loaned out. This isn’t trickle-down economics. That is a totally different thing.

If you can find where a concensus of experts say deflation actually helps workers, I might believe you. It’s my understanding that they don’t think so.

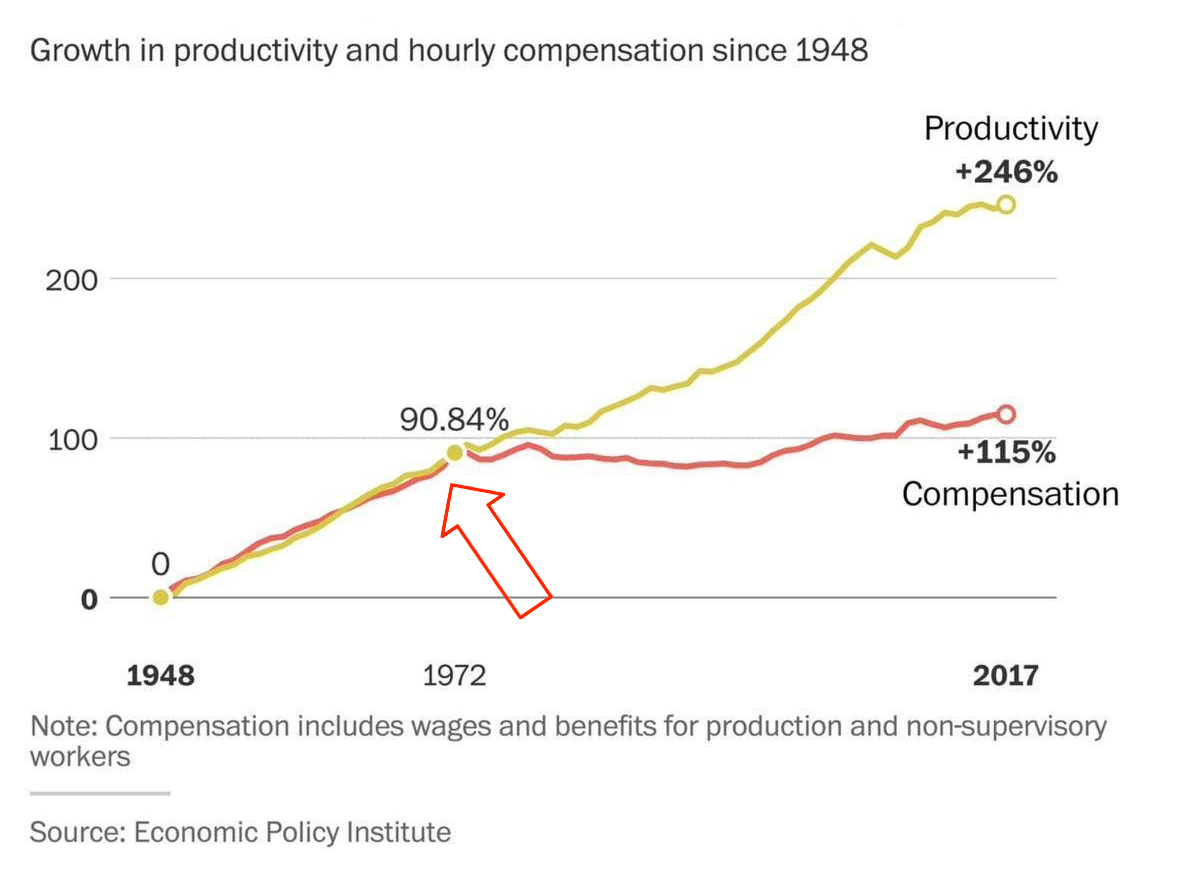

Wages did in fact grow in proportion to the economy before Nixon.

Are we using the same pool of neoliberal economists who brought us here?

Inflation was still positive before, during, and after Nixon. It’s only been negative a handful of times for very short terms.

I’m not sure what Nixon has to do with anything.

I’m arguing that wages would increase in proportion to the economy, not that inflation would never be negative.

The Nixon Shock brought us inflation as we know it today. He lied that it would be temporary. The Keynesian rationale was adopted after the fact.

This argument is much weaker, but: most Republican economic policy sounds good at a surface level but actually hurts workers in practice. And I don’t think that’s by accident.

That gap growing has nothing to do with inflation as far as I’m aware. As you can see from the link I posted above, inflation has been consistently positive since 1933, yet the gap you’re talking about between compensation and productivity doesn’t show up until much later. Obviously it must be another factor.

Unions are how we get better compensation, not deflation. As the power of unions decreases people make less compared to the productivity they provide.

“Percentage of years positive” isn’t as informative as average inflation, which has been significantly higher since the Nixon Shock.

Deunionization absolutely is a major factor around the same time, no disagreement there. We need more savings to strike effectively. We deserve to both earn and keep the full value of our labor - without being forced to invest in the exploitation of others.